The Basic DeFi Stack

Non exhaustive list of the DeFi Stack

Layer 0 – Ethereum Network and ETH

Oracles

Layer 1 –Stablecoins (Collateralized/Algorithmic Stablecoins)

Layer 2 – Decentralized Exchanges (AMMs)

Layer 3 – Lending Markets

Layer 4 – Derivative Markets

Layer 5 – Protocol Aggregators (Yield Aggregators, AMM Aggregators)

Creating a Full Stack of Value

What if a protocol could capture multiple layers of the DeFi Stack? It would be one of the most powerful tools in capital efficiency. A DeFi Full Stack with the benefits of composability while also significantly reducing the external fees and risks from needless interactions with other protocols.

This is exactly what Frax aims to do.

Frax is creating a protocol where value is created both internally and externally. Users and other protocols will be able to leverage the Frax Ecosystem to create new value. I will have to go through the basics of the FRAX stablecoin and its AMOs. Feel free to skip to Future of Frax if you are familiar with how Frax works.

Stablecoin.

Having control over the stablecoin layer is the equivalent of having direct control over liquidity.

Frax is the first algorithmic stablecoin whose supply is autonomously governed by a ratio of collateral and algorithmic supply mechanism. Through the interactions of supply/demand, arbitrage, and the algorithmic stability mechanisms, Frax achieves its goal of a tightened peg at $1. It appears complicated but is actually a well-choreographed dance of simple interactions. Let’s dive in:

Basics of the FRAX stablecoin

longest section but key to understanding how Frax works

Frax can always be created or redeemed for $1 worth of value.

This establishes the Arbitrage Mechanic for the open market. If FRAX is trading below $1 on the open market, users can purchase FRAX on the open market and redeem it for $1 worth of collateral against the protocol.

Collateral Ratio – Determines the ratio of Collateral to FXS (FRAX governance token) that is used to mint 1 Frax.

If the Collateral Ratio is 100% - Users must deposit $1 worth of USDC or DAI (for example) to mint 1 FRAX.

If the Collateral Ratio is 85% - Users must deposit $0.85 worth of USDC or DAI (for example) and $0.15 worth of FXS to mint 1 FRAX.

FRAX on the Open Market

Equilibrium

If FRAX is trading for $1, the market has accepted the current Collateral Ratio and the system is working fine - nothing happens.

FRAX is greater than $1

If FRAX is trading above $1, it means there is high demand for the FRAX stablecoin. Unlike other stablecoins, the FRAX supply is elastic. It can change with demand of the market.

Frax will automatically drop the Collateral Ratio down 0.25% (for example), so that in order to mint Frax you only need 99.75% worth of collateral and .25% of FXS. And because the system is now overcollateralized, Frax could then be minted by the system to buy and burn FXS. Accomplishing 3 things:

Increasing supply of Frax

Lowering the perceived collateral needed for the market to value 1 FRAX : $1

Channel profits from the system to governance token holders.

FRAX is less than $1

If the market thinks the Collateral Ratio is too low, the FRAX price will drop.

If 1 Frax is trading below $1, the reverse will happen. Collateral Requirements will move upwards until Frax is trading for $1 again. Arbitrage opportunities will drive the price back up to equilibrium since 1 Frax is always redeemable for $1 worth of collateral. Users will also be able to recollateralize the FRAX system by depositing collateral and minting FXS at a discounted price.

This well-choreographed dance between the market, arbitrage opportunities, and the elastic supply of FRAX, creates a stablecoin that can scale quickly with demand and maintain its peg. It is referred to as the Base Stability Mechanism. Unlike other collateralized stablecoin where over-collateralization is required, FRAX requires the exact amount of collateral the market deems necessary. It is the definition of capital efficiency.

AMOs

Algorithmic Market Operations (AMO) function with a basic premise of maintaining the FRAX peg. Using the Base Stability Mechanism as a guideline, Frax can introduce new internal markets to the protocol as long as the AMO maintains 4 simple rules:

Decollateralize - the portion of the strategy which lowers the Collateral Ratio

Market operations - the portion of the strategy that is run in equilibrium and doesn't change the Collateral Ratio

Recollateralize - the portion of the strategy which increases the Collateral Ratio

FXS1559 - a formalized accounting of the balance sheet of the AMO which defines exactly how much FXS can be burned with profits above the target Collateral Ratio

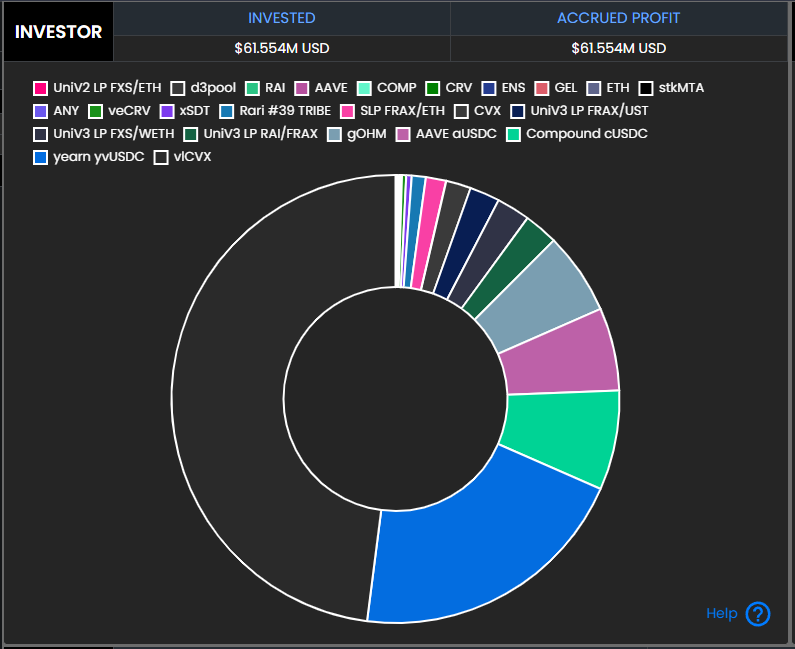

Using the guidelines, FRAX can now use the collateral the system receives to perform market operations such as: Investing, Lending, Liquidity, etc. All of these operations allow the Frax system to generate profit for governance token holders and increase the available supply of FRAX the system can use. In the last 6 months, The Frax protocol has accrued ~$64 million worth of profit.

I’ll quickly run through some of the AMOs that are currently operational. The direction Frax is heading in is more interesting for me.

Liquidity

The ability for the Frax system to mint FRAX creates interesting interactions. The Curve AMO, for example, allows Frax to directly use newly minted FRAX and idle collateral to its own FRAX3CRV pool. This lets Frax to generate income from the swaps occurring in the Liquidity Pool in addition to earning additional rewards in the form of CRV and CVX.

Frax-as-a-Service lets other protocols approach Frax for deeper liquidity. Using a combination of CRV, CVX, and minted FRAX, Frax is able to further direct liquidity to whatever FRAX pair the protocol wants.

Investing

The idle collateral the Frax owns is used to generate income using a variety of strategies including Yearn, Convex, Aave, and Compound.

Lending

Frax is able to directly mint FRAX into lending protocols. This is a key feature that other stablecoins do not have control over. And because borrowers on these platforms are over-collateralized, the minted FRAX does not affect the Collateral Ratio. This grants Frax a high degree of control over interest rates for borrowing Frax.

veFXS

veFXS uses the vote escrow mechanism that has seen an amazing amount of success in the CRV ecosystem. Users lock FXS to receive veFXS. veFXS is used to vote on gauge weights, Frax government proposals, and receive boosted yield on certain farming rewards. Convex has begun accepting FXS deposits. Similar to what Convex is doing with CRV, they are max locking FXS and in return users receive a liquid veFXS in the form of cvxFXS. If the relationship between CRV and Convex is any indication of what will happen to FXS, the Frax ecosystem is preparing to become an even larger player in the DeFi landscape.

Future of Frax

Remember the DeFi stack?

It’s all coming together now. With the stablecoin layer fully operational and efficient, Frax is able to expand both internally and externally. The most successful protocols add value to a system. The Frax system will not replace or compete with existing protocols, it will add additional value to the Frax token holders and other protocols that use Frax system for liquidity. The Frax Team is always willing to cooperate with other protocols and grow the overall ecosystem. There are numerous projects launching using Frax to bootstrap their treasury (see: $OHM, $TEMPLE, $ROME, and other OHM forks). Nothing but positive experiences when working with the Frax team.

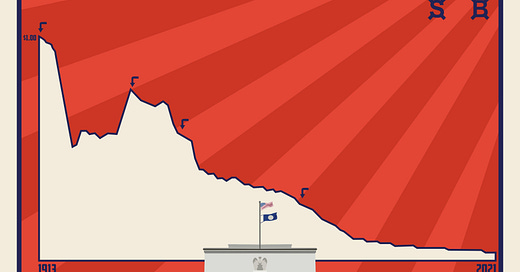

Frax Price Index

The alternative to the Consumer Price Index and Stablecoins

Another innovation the developers of Frax are working on (and will soon launch) is the Frax Price Index (FPI). The FPI aims to be a decentralized alternative to the Consumer Price Index (CPI). The CPI is a critical measure of U.S. Inflation. The CPI has seen its fair share of criticism, ranging from being an inaccurate measurement of inflation to being purposefully misleading in how it is calculated. You can read more about the the various controversies here.

How does that fit into crypto?

Despite decentralization being a key ethos in the sphere, the web3 economy is still pegged to the U.S. Dollar. Which means the US Dollar holds a tremendous amount of power in crypto. The benefits and risk of utilizing the USD as a measurement of value in web3 is an important structure that web3 citizens have no control over. Holding $USD pegged stablecoins exposes users to high inflation rates that the $USD is currently facing.

The Frax Price Index offers a solution. At launch the FPI will track the CPI, but eventually veFXS holder will have a say in how the FPI is calculated. This will effectively decentralize a key metric of the web3 economy. The FPI will offer a new type of stablecoin – a fully decentralized stablecoin that tracks inflation based on transparent mechanisms. If executed correctly, the FPI will be an influential protocol in the DeFi Landscape. that will allow users to maintain their purchasing power in a world of inflating macro-economics.

The fact that Frax is launching the FPI, means FPI will receive immediate benefits and use cases. New stablecoin projects must spend their limited resources to build liquidity, attract collateral, and court a userbase that isn’t transient. However, the FPI will be able to leverage the existing Frax Ecosystem to bootstrap itself - instantly gaining utility, liquidity, and holders.

FPI Airdrop

FPI will be airdropped to the following FXS holders (information subject to change on official announcement):

veFXS holders – By locking up FXS users receive vote escrowed veFXS. veFXS holders can vote on Frax proposals, the Frax Gauge, and eventually FPI related issues. FXS holders who have locked up to 4 years will receive a larger amount of FPI.

cvxFXS – a liquid veFXS – deposit FXS into CVX, they will max lock it and you will receive cvxFXS.

FRAX/FXS LP (Uniswap LP)

FXS in Tokemak

The weight will favor veFXS holders more than unlocked FXS. Effectively airdropping FPI to the users most aligned with the long term success of the FRAX ecosystem.

Potential Future Frax AMM - Frax Swap

Expansion into the DEX stack

Using the collateral that Frax owns, the FPI will immediately have access to deep liquidity while also being useful. With the potential introduction of a Frax AMM (Frax Swap), users will be able to trade (FRAX/FPI) against the protocol for Protocol Owned Collateral. And the fact that FRAX is multichain means smaller users will be able to leverage the larger FRAX ecosystem and trade against deep liquidity without paying large fees using FRAX and FPI.

FRAX and FPI benefit for trading activity against the Frax protocol collateral. Bringing in FRAX/FXS pools from Sushiswap and internalizing it reducing dependencies from other protocols while also reducing fees for the system and end users. This also allows another avenue for Frax to mint/redeem its stablecoins. New FRAX/FPI could be directly minted into trading pairs leveraging the protocols collateral allowing the balance sheet to expand or contract as needed.

veFXS holders will be able to vote on which Frax pools receive the most FXS incentives. Imagine the CRV gauge but applied to Frax pairs. Curve plays an instrumental role in the growth of stablecoin projects. Frax will play an instrumental role in the growth of non-stablecoin projects. In The Liquidity Wars, liquidity is king. And Frax is poised to be an even greater player.

Frax Lending System

Expansion into the Lending Stack

Another potential area for Frax expansion is the Lending Stack of DeFi. Currently Frax is utilizing numerous lending protocols for their lending operations. By creating an internal lending system, Frax will have an even finer control over the FRAX/FPI supply (think: set interest rates). Users will be able to deposit collateral into Frax, or even use veFXS they have locked up, and take out loans.

Future Power Of Frax

FRAX stablecoin is highly successful and will trend towards a lower Collateral Ratio as the market values the strength of the Frax ecosystem.

Frax Price Index (FPI) - allows users to maintain purchasing power without losing value to inflation.

Frax AMM - An internal AMM will give FRAX and FPI holders an immediate highly liquid market to use trade against. As the Collateral Ratio lowers, the Frax system will be able to mint directly into different pairs offering more liquidity to different pairs.

Frax Lending - Users deposit collateral to borrow against the protocol. FRAX will be able to set interest rates directly without having to depend on other protocols. It also gives the Frax protocol the benefit of giving collateral status to tokens they accept as deposits. Protocols can approach Frax to accept their tokens as collateral meaning their tokens also become a productive asset - users can use Frax to yield farm.

[Redacted] Cartel, Convex, and veFXS

Since this also serves a Part 2 to the original post, I’ll discuss the interactions between these platforms.

Frax has been an early pioneer in utilizing Convex to its full potential. To put it in perspective, even after emissions, Frax is making $80-$100 million in profit through its various AMOs, Convex bribing, and LP strategies.

Convex has begun accepting FXS and max locking it (4 year lockup) and in return users receive a liquid veFXS in the form of cvxFXS. This will reduce the circulating supply of FXS - an overall benefit for the Frax ecosystem. This benefits users in 2 ways:

Liquid version of FXS - cvxFXS

Increased yield on FRAX and FPI LP pairs without having to personally own veFXS

In return, the Convex system (CVX holder) will receive a share of the profits the Frax protocol generates and distribute to veFXS holders.

[Redacted] Cartel plans to bond for FXS and already has a large amount of CVX tokens. With Frax bonds, Redacted will earn yield from locking up Frax via cvxFXS, providing liquidity for the cvxFXS/FXS pool, and the Frax Consumer Price Index airdrop to veFXS holders. Notice how everyone is benefiting in this ecosystem. Convex gets more Frax, the cvxFXS/FXS pair is strengthened, and more FXS is locked up meaning Frax can be comforted that FXS will be in good hands.

CVX and FXS tokens will be a source of continuous revenue for the [Redacted] Cartel treasury. Since the role of [Redacted] Cartel is to become a meta-governance token, the real value of owning FXS is the voting power. The ability to vote on the Frax Gauge, have a say in what the FPI tracks, and other various governance proposals, holds immense future value.

The future is bright for Frax, Convex, and [Redacted] Cartel.